Managing credit risk proactively helps businesses reduce bad debt, improve cash flow and protect revenue — especially when dealing with a large customer base or multiple suppliers across regions.

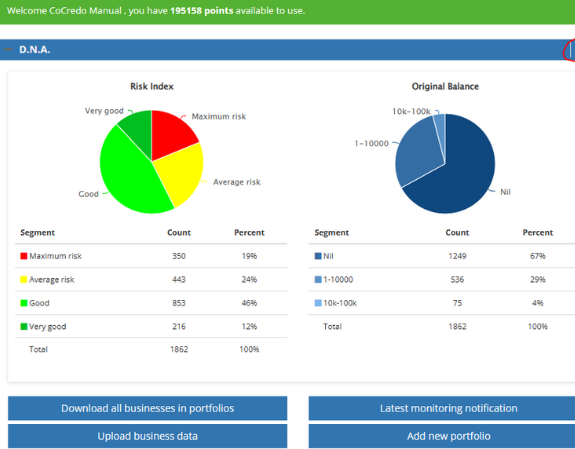

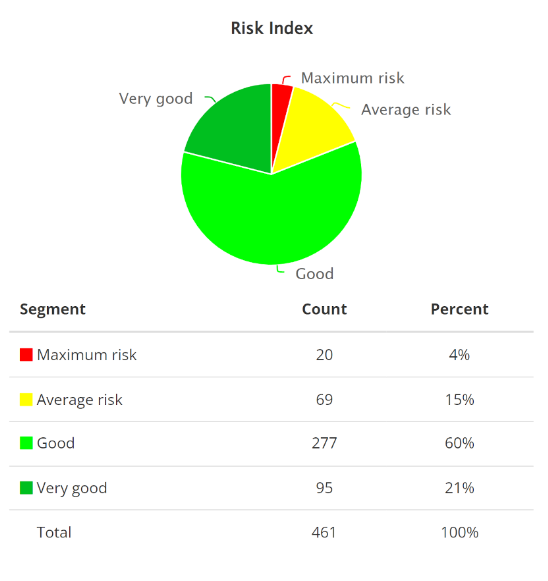

CoCredo’s D.N.A Credit Portfolio Manager gives you a 360° picture of your credit exposure by tracking all your portfolio companies in one secure, online tool. With real-time updates and a dynamic risk index, you can stay ahead of changes to payment behaviour or financial stability before they affect your business.

Take greater control over each customer’s risk profile and utilise more innovative credit risk reporting to comprehensively view all credit portfolios.

CoCredo’s D.N.A Credit Portfolio Manager helps businesses of all sizes — from SMEs to international organisations — proactively manage credit risk by giving a complete overview of their credit exposure.

Instead of manually comparing credit reports from different sources, you can view and analyse all relevant credit data in one place, so you can quickly identify high-risk accounts, understand payment trends and respond to adverse financial signals before they escalate

The benefits of using our D.N.A cloud-based credit risk management tool:

Use our online dashboard to consolidate credit checks and manage your ledgers efficiently. Evaluating the creditworthiness of new customers is crucial for effective credit risk management.

The D.N.A Credit Portfolio Manager brings advanced credit risk analysis to your desktop with easy-to-use tools and powerful data integration.

Our features:

This combination of features enables robust analysis and simplified monitoring of credit risk across your customer and supplier base.

Access UK and international business credit reports with credit scores and financial insights across 240+ countries.

Alongside company credit reports, we offer CRM integration, Dual Reports and Business Credit Monitoring, giving you powerful tools to monitor, manage and reduce business credit risk across your customer and supplier base.

Grab your free trial credit report, call us at 01494 790600.

We have assisted thousands of UK businesses in checking their credit scores and providing credit report solutions. We seem to be doing a good job as our clients are always happy to tell us.

Discover why businesses of all sizes prefer and value CoCredo.